Build vs. Buy Payment Orchestration: Which is Right for your Business?

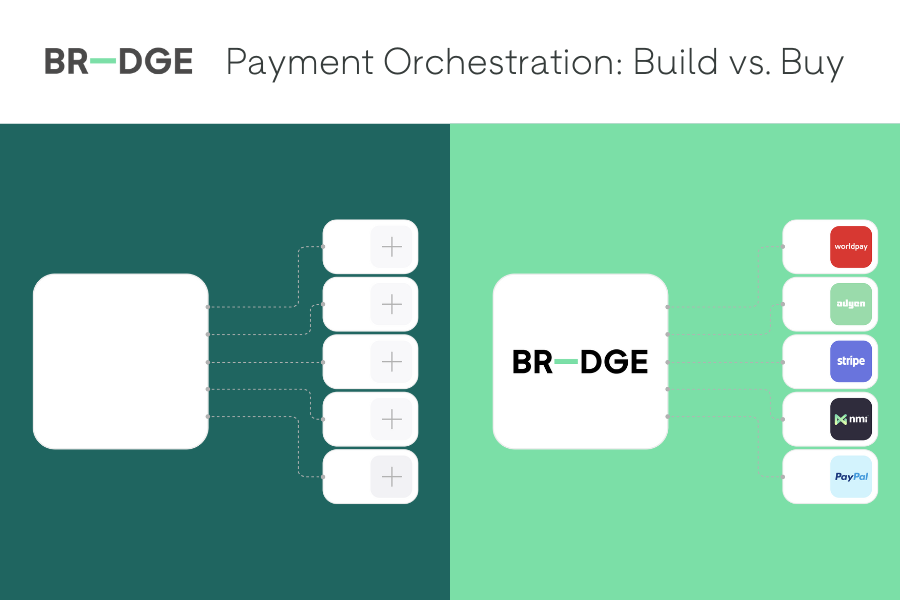

Deciding whether to build or buy a payment orchestration layer is a challenging choice that merchants worldwide face when aiming to enhance their payment infrastructure.

This includes meeting customers' needs and expanding their reach in new markets in the easiest and most efficient way.

A need for addressing the above payment challenges has driven new technologies to emerge, including what is now known as payment orchestration.

Can Payment Orchestration solve your payment challenges?

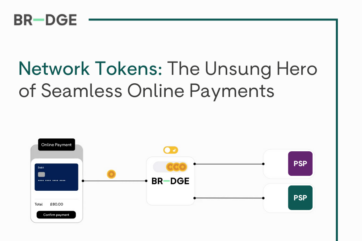

Payment orchestration is a broad solution that solves numerous payment challenges within the payment workflow and can be utilised for different purposes. It simplifies and overcomes a fragmented payment infrastructure by consolidating multiple payment providers, gateways, and systems into a unified platform with a wealth of features, real-time insights and centralised reporting.

With payment orchestration, you can make better data-driven decisions, easily streamline and optimise payment flows and quickly identify growth opportunities. One single API integration allows you to connect to the entire payment ecosystem, providing a resilient and flexible framework for innovation and growth.

The smart routing function ensures that every transaction is optimised and processed in the most efficient and secure way. It reduces the overall cost of payments and improves the checkout experience for consumers. With integrations to multiple payment service providers through one single API, you can use the commercial leverage to quickly expand into new markets, negotiate the best, most competitive rates with PSPs and acquirers and utilise intelligent routing to maximise the efficiency of the payment journey.

Most PSPs are incentivised to capture the ‘lion-share’ of your transactions. However, payment orchestration operates on a different commercial model and payment routing aligns with your individual needs. This enables you to effectively leverage a multi-acquirer strategy which takes into consideration resilience, optimisation of payment success and associated costs.

You can also utilise payment orchestration technology to make your payments more secure without additional friction. For example, central tokenisation allows you to capture, store and tokenise payments, without putting data at risk. This creates a smooth, frictionless online payment experience for your customers.

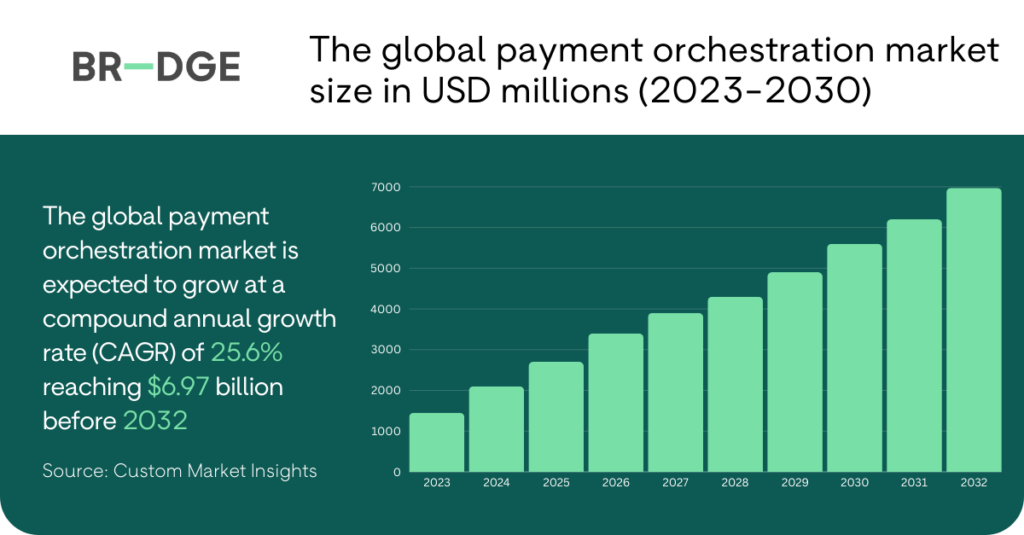

That being said, payment orchestration is still in the early adoption stage. As reported by Industry Research, the global payment orchestration market size was valued at $1.67 billion in 2022 and is expected to expand at a CAGR of 31.52% during the forecast period, reaching $8.6 billion by 2028.

So, if you're thinking of implementing payment orchestration but are unsure whether to build it or buy it, you have come to the right place. In this blog, we will help you weigh the pros and cons of each approach, so you can make an informed decision on what is best for your organisation.

Building Payment Orchestration In-House

While there are many factors to consider, the initial temptation is often to build, not to buy. However, every company is different and developing a payment orchestration platform in-house might or might not be the better approach for you. It all comes down to the scale of payment challenges you are facing and the time and resources you have to resolve them.

Control & Flexibility

The main advantage of building your payment orchestration in-house is full control over the development, testing and maintenance of the platform. You know your business better than anyone else, so with this level of control, you can create a fully bespoke platform tailored to your unique payment processing needs and existing technology.

Also, by developing your payment orchestration platform, your organisation benefits from exclusive ownership of intellectual property. This provides you with a significant competitive advantage and creates an opportunity to unlock additional revenue streams from licencing your technology or its features to other companies.

However, the scale of flexibility you can achieve with this approach ultimately comes down to your resources. Being in full control of your entire payment orchestration technology is a strong advantage but you need to tick a few other boxes to make it feasible.

Costs & Resources

Developing and maintaining a payment orchestration platform is a complex and expensive task, requiring long-term commitment, necessary infrastructure, including hosting servers, databases, and security agreements. Also, to ensure the effectiveness of your payment orchestration platform, you will need to integrate a diverse range of reputable payment service providers and alternative payment methods, which is usually time-consuming and requires heavy ongoing investment.

However, if your transaction volume is high enough to offset the expense, building your platform in-house can prove more cost-effective long-term by avoiding fees you would normally pay to the technology provider for licencing and support.

Depending on the size of your organisation and the pain points you are trying to solve, it can take months or years before you start generating a return on investment. Therefore, you need to carefully consider your budget, timeline and technology needed to overcome your payment processing challenges.

Knowledge & Expertise

Payments is an ever-evolving industry which requires your continuous effort to keep up to date with new trends and technologies. When building your payment orchestration layer, your business will need a team of skilled people with the necessary knowledge and expertise around payments security, compliance, and regulations.

Assessing your team's capabilities and weighing the benefits of in-house expertise against the costs and challenges is essential in determining whether building payment orchestration in-house is the right choice for your business.

Development/Implementation time

As you already know, building a platform that works seamlessly with your existing payment infrastructure is a time-consuming process, involving extensive development, testing and refinement.

Your development and implementation time will depend on the size of your team, the allocated budget and your payment challenges. Devoting additional funds to building your platform will help you expedite the process, but it may also divert resources from other critical functions of your organisation and prevent your development team from moving other projects forward.

Make sure to carefully consider the impact this can have on your team’s capacity and other areas of your business operations. It’s important to find the right balance between allocating efficient resources and maintaining the overall success of your business.

Features & Scalability

The payment orchestration landscape is diverse, with each platform offering its own unique set of features and capabilities. Your company’s resources and the complexity of the payment challenges you are trying to solve will dictate how you build your technology in terms of features and scalability.

The most common features of payment orchestration include centralised payment management, multiple payment method support, intelligent routing and optimisation with custom payment workflows, consolidated real-time monitoring and reporting, advanced fraud prevention and payment security, network tokenisation, and seamless integration with various payment providers.

Remember that while you may have initially designed a payment orchestration solution that meets your company’s current needs, accommodating future growth can present new challenges, including new payment methods and integrations. Also, your payment volumes can fluctuate significantly, so you need to ensure that both your team and technology can handle this and avoid processing delays, errors, and other issues.

Keeping up with changing consumer demands, maintaining increased transaction volumes or even handling any minor issues will require additional investment in infrastructure, resources, and expertise. Therefore, consider the long-term implications of maintaining your platform if you decide to develop it in-house.

Maintenance & Support

Payment issues are common and as the industry constantly evolves, new payment methods, technology and regulations are emerging every day.

Once you build your payment orchestration layer, it is essential that you ensure ongoing maintenance and support of your platform, including new integrations, updates and bug fixes for optimal performance and security.

However, the focus on maintaining your platform and the costs associated with it may limit your company’s ability to innovate and quickly respond to market changes or customer demands, so consider this before deciding to build your solution in-house.

Buying Payment Orchestration from a provider

As we discussed above, building a payment orchestration in-house provides you with full control over the development and maintenance of the platform, but usually, the time and costs involved with building and upkeeping such a complex payment infrastructure make it impractical for many organisations.

In most cases, partnering with a payment orchestration provider is a more feasible and efficient approach. By leveraging the expertise and infrastructure of a third-party provider, you can focus on your company’s core operations and benefit from a proven solution that enhances your payment capabilities and drives growth in the market, without the burdensome development and maintenance process.

Control & Flexibility

While you may not have direct control over the technology’s core infrastructure and features, payment orchestration providers develop their platforms understanding that each business is different and faces its own set of unique payment challenges. They offer robust and modular solutions that can be easily tailored to fit the payment needs of your organisation.

At BR-DGE, we have a feedback loop to provide our merchants with the opportunity to influence or request new features or functionality and ensure that our technology continues to meet the needs of merchants and consumers alike.

By utilising payment orchestration platforms, like BR-DGE, you can access a wealth of features, payment services and tools through a single API, gaining greater control and flexibility over configuring payment processes, integrating with existing systems, and adapting to changing market conditions with ease.

Always explain all your payment challenges and needs in detail when contacting a payment orchestration provider to ensure you receive the best-tailored solution for your organisation.

Costs & Resources

Payment orchestration platforms often provide flexible pricing to suit the type of business, from fee-per-transaction models to fixed-fee subscription-based plans. While some providers require upfront costs, others may offer all-inclusive pricing with no extra fees.

The total cost of purchasing payment orchestration services will differ between different providers and is usually determined by the size of your organisation and the volume of your transactions.

By partnering with a payment orchestration provider, your company avoids significant upfront investments in hardware and personnel, as well as the time-consuming and complex process of research, development, and maintenance of the platform. This more cost-effective approach reduces total ownership costs and allows you to focus on your organisation’s core revenue-generating activities.

Knowledge & Expertise

Payment orchestration providers are specialists in the field, with a deep understanding of the complex payment ecosystem and security compliance regulations, such as PCI DSS or PSD2, that can be invaluable to your business. They spend years researching, developing and improving their platforms, to provide a reliable, competitive and efficient payment solution, so you don’t have to.

Working with a payment orchestration company provides you with a wealth of payment knowledge and expertise. Their extensive experience will help you navigate industry challenges, streamline your payment process with confidence, leverage best practices and be at the forefront of consumer needs, emerging trends and technology, which would be more challenging to achieve in-house.

Development/implementation time

Since the platform is already developed and tested, working with a payment orchestration provider allows for a much-speedier implementation process with minimal downtime. They provide your organisation with all the necessary features and capabilities at a fraction of the time it would take you to build it in-house, and usually at no extra cost. In fact, working with a third-party provider help merchants save up to 5300 hours of internal development resources and increase their time to market by up to 88%, according to our research.

Also, payment orchestration layers are usually designed as plug-and-play solutions that slot into your existing payment flows, allowing you to quickly integrate new payment services through a single API and manage all transactions from one platform.

If you’re looking for quick and easy implementation, working with a payment orchestration provider is a better option.

Features & Scalability

Based on cloud architectures, payment orchestration platforms are scalable, modular solutions that grow with the business. Most providers offer a comprehensive suite of features that are designed to ensure that your payment infrastructure remains agile, efficient and future-proof.

Payment orchestration platforms are designed to be highly resilient, fault-tolerant, secure, and capable of handling thousands of transactions per second. They provide you with access to a wealth of payment services and alternative payment methods as well as built-in security features, extensive reporting and analytics, dynamic switching capability, and more.

Purchasing from a provider allows you to focus on scaling your business without the ongoing investment in specialist technical resources and complex technical project changes in your payments infrastructure. Your provider's expertise, continuous experimentation and effort in expanding their platform's features will allow you to stay at the forefront of payment innovations and consumer needs.

Maintenance & Support

By working with a payment orchestration provider, you gain the advantage of ongoing maintenance and support of the platform from experts in the field. Paying for the service often offsets the expense of self-maintaining an in-house solution and allows your organisation to focus on streamlining the payment process without having to worry about the stability of the platform.

Also, your provider handles any ongoing scheme and payment regulatory changes, ensures the reliability and security of the platform and deals with any bug fixes or technical updates for you. Their extensive knowledge and experience in the field provide your organisation with the best and most reliable support, so you can quickly adapt to changing payment needs, volumes, and regulations with ease.

Final thoughts

While building your payment orchestration platform in-house offers greater control and customisation, it requires significant resources, expertise, and time. Buying the technology from a provider not only saves you money and time but also allows for quicker implementation and provides you with access to expert knowledge and ongoing maintenance and support.

Regardless of your method, remember that your focus should always be on the customer. Providing easy, frictionless, and secure transactions while offering a wide range of preferred payment methods will help you optimise the payment experience.

Before deciding which approach is better for your business, make sure to consider your payment challenges, carefully evaluate all the factors we discussed in this blog or ask yourself these questions:

- Does my business have enough budget and resources to build, maintain and scale the platform?

- What is our implementation/go-to-market time objective?

- How much time can we dedicate to the development and maintenance of the platform?

- Does my business have the necessary knowledge and expertise in payments?

- Will building a payment orchestration platform affect our core business activities and priorities?

How we do it at BR-DGE

At BR-DGE we understand the complex payment challenges facing merchants and we spent years developing an intuitive payment orchestration solution that empowers you to innovate, scale and adapt.

Our story started at Stagecoach when our founder Brian Coburn was faced with a multitude of payments pain points and went in search of a technology that enables more power and control over the end-to-end payment process.

In his role as then CTO, he transformed legacy systems and pioneered changes in payment technology that created new revenue streams and enhanced customer experiences from one end of the country to another. He then brought this experience, drive and desire to disrupt the payment market, building our orchestration solution.

Today, the BR-DGE team is comprised of payment experts, designers, developers, researchers, and product owners, who collaborate cross-functionally to deliver our cutting-edge payment orchestration platform since 2018.

With a wealth of payment expertise and experience across the team, we empower our clients to take control of their end-to-end payments journey for greater resilience, improved margins and a seamless customer payments experience through a single API.

Our technology is constantly evolving and allows you to reach new markets, respond to consumer preferences, control and minimise payment transaction fees and ensure a continuous flow of payments; all through a centralised, independent platform that integrates seamlessly into existing processes.

The flexibility and agility of our platform allow you to work with PSPs and acquirers to negotiate the best, most competitive rates for new market currencies and utilise intelligent routing to maximise the efficiency of the payment journey. With BR-DGE, you can design a compelling payment process to expand your global audience and adopt new payment methods that are local to your new customer base.

Our payment orchestration platform is PCI Level certified and ISO 27001 ready and has been successfully tested for 100,000 transactions per second. It’s designed to be resilient, with multi-cloud, multi-region architecture and no downtime upon release deployment.

If you would like to find out more about how BR-DGE can support you in solving the biggest problems in your payment journey, contact us today.

Related content