Empowering

global growth

and connectivity

through payment

orchestration

Payment orchestration for the whole ecosystem

BR-DGE is an innovation enabler for the payments ecosystem. We provide a technology anchor-point that empowers merchants, financiaI institutions, payment providers and platforms to increase revenue, optimise costs, and manage payments performance.

Modular

Independent

Flexible

Scalable

Interoperable

Resilient

The BR-DGE Platform

Working with BR-DGE means our customers have simple, secure access to a global selection of best-in-market payment technologies and providers. This connectivity is backed up by smart routing, data insights, customisable payment flows, tokenisation and flexible fraud solutions, to deliver a comprehensive range of benefits.

Our platform is modular. It enables you to choose and customise the best tools for your business, even as your needs evolve.

The value of BR-DGE payment orchestration

Our customers have seen a variety of great results, including;

average saving on payments costs

reduction in development time and resources

rescued revenue from failed payments

Who we serve

Our payment orchestration technology is built for businesses throughout the value chain

BR-DGE for Enterprise Merchants

BR-DGE for Payment Providers

BR-DGE for Platforms

BR-DGE benefits

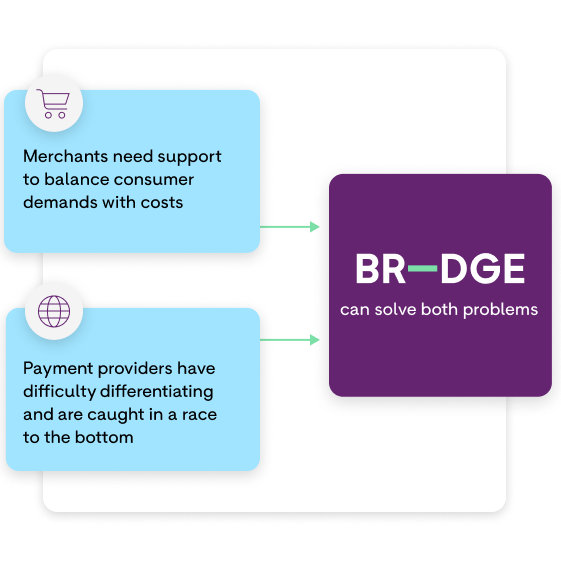

BR-DGE focuses on listening to the market and building technology solutions that solve merchants’ and payment providers’ biggest challenges. Whether you’re facing challenges around efficiency, resilience, or revenue growth, we can provide the payments infrastructure to meet your needs.

BR-DGE Payment Orchestration is:

Built-for-purpose, scalable technology

Designed to drive interoperability, innovation and efficiency

Customer-led, with flexible, tailored flows

Platform-agnostic, creating value for the entire ecosystem

We power:

Optimisation of acceptance and costs

Simplified processes and speed to market

Resilient routing that captures revenue

Customisable payment flows

Secure, compliant tokenisation

Creating value and interoperability

BR-DGE was built purely for the purpose of payments orchestration. We are a completely independent, vendor-agnostic technology layer.

This allows us to facilitate a thriving merchant payments ecosystem that benefits all players in the value chain.

By integrating with our independent payment orchestration platform, you can scale, break into new markets, introduce innovative features, optimise costs, and quickly adapt to changing consumer expectations.

Why BR-DGE?

Independent and customer-centric approach

Fully modular, flexible technology

Secure, PCI Level 1 certified and SOC2 compliant

Multi-cloud, multi-region architecture

Customisable payment workflow capability

Direct connectivity through a single integration

Highly scalable, future-proof infrastructure

Bridging the ecosystem

We’re committed to building lasting partnerships and we work hard to build relationships with companies who share our values and deliver benefits to our customers.

While our partners add connectivity to our platform, we also work together to address wider payments challenges and opportunities. This is a big part of our commitment to delivering value to the whole value chain.

Latest Insights

Get started with payment orchestration.

The BR-DGE payment orchestration platform has extensive capabilities, from real-time data reporting to an extensive routing engine, network tokenisation services and access to over 400 connections across the entire payments ecosystem.

Contact our team to discuss your organisation’s unique requirements.

Contact us