How many payment methods do you need?

In a recent webinar educating on the role of payment orchestration in the payments ecosystem, one audience member posed an interesting question; just how many payment methods do you need? Do we really need over 200 payment methods to be competitive and offer the best user experience?

The answer is unique to every business.

The decision around payment methods is intrinsically linked to customer understanding and experience, delivering what your customers want, expect, and need in order to drive conversion behaviour. It is less about the volume and more about the flexibility and choice you have that elevates your customer experience.

By adopting the payment methods that your customers prefer, you can build a targeted payment strategy that drives business growth, secures market share, improves acceptance rates, and reduces cart abandonment.

Understanding your audience

Research from The Paypers suggests that the major card brands have a market share of roughly 23% worldwide, while more than 70% of all consumer transactions are paid via bank transfers, digital wallets, and cash-based payments. However, every market has their own preferences, from device-type to card or alternative.

Most decisions to promote greater conversion in the ecommerce environment are based on concrete data, captured throughout the customer experience journey. Small tweaks and iterative changes based on this data and insight ensure that the experience is maximised for every individual. The payment experience should be no different. Just as you would localise the language and imagery across your website for a new territory or offer different types of point-of-sale promotion for different customer segments, your payments experience should be personalised and relevant for every customer.

Payment data captured throughout the buying cycle across your ecommerce site can be consolidated and overlayed across your customer personas, so you have a rich picture of not only shopping preferences, but payment preferences too. Some of these may be logical preferences, such as the leading payment method for a particular currency or country, others may be more unique to each customer persona, such as e-wallets or the latest Buy Now Pay Later (BNPL) integration.

It is not about the volume of payment methods and more about ensuring the relevant options are available to the right audience, at the right time for purchase.

Developing a customer-first payment experience

Long gone are the days of one-size-fits-all online experiences and with data, you can dynamically route your customers through a journey that best suits their needs, ultimately leading to the best checkout experience too. Through the use of intelligent routing, you can set clear criteria for each individual customer journey, whether you set rules around country, currency or basket-value preferences, each segment of your audience can receive the best payments journey for them, to maximise the chance of conversion and minimise basket abandonment.

By adopting the payment methods that your customers prefer, you can design an end-to-end ecommerce experience that meets customers’ payment preferences, driving higher customer satisfaction, reaching more customers, optimising costs, reducing fraud and disputes, and maintaining your competitive edge.

Speed of innovation

The global payment landscape is complex and incredibly diverse, whilst also continually evolving. Today’s innovation is tomorrow’s expectation and as new payment methods emerge and gain traction, you need to be able to stay one step ahead.

Integrations can be a costly and time-consuming exercise and often pose a challenge for a merchant looking to keep abreast of the latest trends and customer expectations. When reviewing your payment methods, it is crucial to be forward-planning and looking at the latest payment trends and how your decisions today, may change tomorrow.

It is hard to predict the future, especially when new payment methods are appearing on the market every day. However, by utilising your own data and combining it with research and insight from players across the payments ecosystem, you can get a feel for what is on the horizon. For example, in the last 12 months we have seen a surge in interest for Buy Now Pay Later (BNPL) solutions and Open Banking is finally gaining traction, with 500,000 new adoptees in January alone in the UK this year (ComputerWeekly.com), with a total of 5 million users now active in the UK. This kind of data can prove insightful for decisions surrounding what payment methods are right for your ecommerce store right now and what is likely to be a requirement for your audience as they move to adopting new payment methods.

You also need to remember, that whilst there are hundreds of online payment methods, most businesses organisations only need a select few to truly meet the needs of your customers.

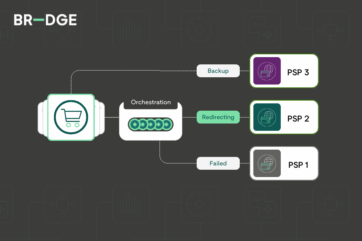

The rise of the orchestration layer

Consolidating complex reports on customer behaviour and preferences and embarking on a widespread integration plan can be a lot to take on, but it can also be invaluable in ensuring maximum online conversion. Over the last few years, payment technology has come to the fore, providing a solution. The payment orchestration layer.

Payment orchestration is not just about providing choice, but about empowering merchants to make the best commercial decisions for their business and their evolving customer base. Whether it is through consolidating payment reporting to better understand your customer or looking at ways to dynamically route customer segments or new territory payment experiences; payment orchestration offers the solution.

Working with a payment orchestration platform, like BR-DGE, enables you to remain at the forefront of payment technology. You can test, add and innovate with new payment methods at unmatched speed, responding to the direct needs of your growing customer base. With payment orchestration you have all the flexibility and control, without the hassle and this speed creates limitless opportunity to adapt and change your payment stack to match your businesses current needs and those of your customers instantly.

Final takeaway...

The payments landscape is rapidly evolving, but decisions still need to be based on insight and data gathered from your existing processes. Although it is brilliant to see merchants adopting the latest payment methods, it is critical that you do not lose sight of the real goal, providing an exceptional end-to-end online customer journey.

A successful payments strategy isn’t about offering the most payment methods, it is about offering the right payment methods in the right markets; whether that is 20 or 200 options.

To find out more about how BR-DGE can support you in accessing the right mix of payment methods for your customers, get in touch with the team today.

Related content