Beyond Redundancy: Why Resilience Isn’t Just a Backup Plan

Many merchants stick with one payment provider, to begin with. It feels tidy: one contract, one set of reports, one team to call if something goes wrong. But when that provider slows down, everything slows with it. Transactions hang, queues build, and sales slip. With only one route, you’re betting the business on someone else’s tech.

The way out is to have more than one route ready to go. If one provider stumbles, another picks up the traffic straight away. Payments carry on in the background while customers keep buying, and the outage becomes a non‑event. This built-in redundancy is the safeguard that turns outages into routine reroutes and keeps merchants trading on their own terms.

Coverage gaps merchants can't ignore

Redundancy sounds simple, but the data shows how few merchants have it in place. BR‑DGE’s 2025 survey shows that 71% of enterprise merchants send between 50% and 70% of their payment volume through a single processor, while 27% send between 71% and 90%.

Only a minority have automated backups ready. Just 32% of merchants said they have full failover in place, where traffic switches instantly between providers in the event of an outage. Forty‑two percent have partial cover, 18% have none, and 8% aren’t sure.

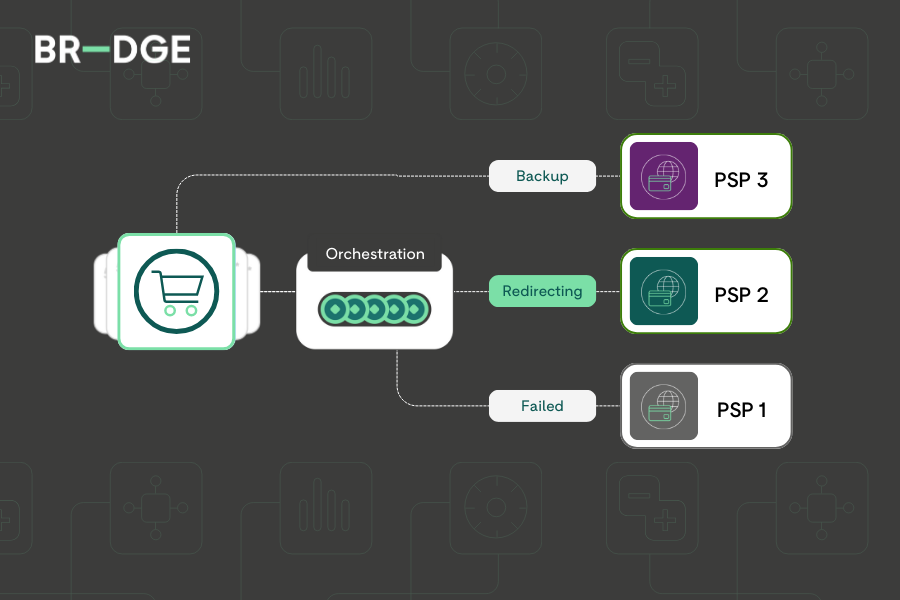

Failover is simply how redundancy works in practice. It’s the automatic hand‑off when one route falters and another takes over. Customers don’t see the switch and merchants don’t lose sales or customer goodwill. Instead of outages, merchants see continuity.

Redundancy in action

Here’s an example of what redundancy looks like in practice. A multi‑market gaming platform connected two providers through orchestration. Over a 10‑month period, their primary route stalled several times. Each time, traffic switched automatically to their secondary PSP seamlessly.

Because of that, £250 million worth of payments that would have failed were processed successfully. Customers kept playing, revenue kept flowing, and the outages never made the headlines. Redundancy showed its value: payments flowed - and customers stayed engaged.

Redundancy as everyday control

Failover explains how redundancy works in the moment: traffic switches when a route stalls. But resilience goes further. It’s about merchants keeping control of their payments (and their customer experiences) every day, not just during outages.

With automated multi-layered routing, payments don’t just survive disruption; they work smarter: failed transactions can be retried or rerouted automatically, traffic can be steered to the best‑performing provider, and new markets can be reached faster through local acquiring.

That means:

- A customer’s card is declined at checkout: instead of losing the sale, the automated retry clears it through another provider

- During a flash sale, traffic is steered to whichever route is authorising fastest, so carts don’t hang and sales aren’t lost

- When a retailer opens in a new country, payments can be processed locally. Customers see faster checkouts and are less likely to abandon their purchase

- Finance teams see all routes in one place. Via orchestration, adding a new provider or innovation is low‑lift, without the overhead of separate contracts and reconciliations

Download the Payments Resilience Playbook

The BR‑DGE Payments Resilience Playbook shows how enterprise teams are putting redundancy into practice. Built on real merchant examples, it sets out clear steps to close coverage gaps and keep revenue flowing without disruption.

Download it now to see how redundancy becomes the foundation for flexibility, optimisation and future‑readiness.

The Payments Resilience Playbook is available to download now.

Related content