Payments 101: balancing volume in payments

As a digital merchant you are constantly looking at ways to improve your customers’ experience while simultaneously optimising your systems efficiency. In 2023 payments have gone from being a hygiene factor at the end of the customer journey, to playing a key role in customer conversion.

For a merchant to offer a fluid and inclusive online experience, you must reflect on every stage of the end-to-end process, including payments. With over 8.4% of online transactions resulting in failure and many merchants experiencing website crashes or loading issues on payment pages during surges, it is critical you design a process that not only works for your customers, but for your internal execution too. In maximising the power of payments, you can go beyond just reflecting on what options sit at the checkout, but also consider the ease and speed of the experience.

As a merchant that experiences seasonal trading peaks or one that regularly has new product or ticket drops, you know that the payment experience can be a point of friction. Even with a robust process in place, resilience can be knocked when put under immense capacity or pressure and therefore merchants like you, need to reflect on balancing volume. Designing and deploying a resilient payment technology stack not only reduces tension at the checkout for your customers, but maintains your digital customer loyalty and reduces internal stress during peak trading times.

How do you manage seasonal peaks and increased volumes?

In periods of peak trading a payment provider outage compromises your ability to trade and has a severe impact on your customers with 30% of consumers stating they blame the merchant for the payment failure (BR-DGE Consumer Survey 2023). With an intuitive and resilient technology stack in place to handle volume, you mitigate the risk of failed payments, lost transactions, and a poor customer experience. Through utilising technology such as payment orchestration, you can connect to a broader range of providers, dynamically route transactions for better optimisation and provide a streamlined customer journey through to checkout.

Access to a wealth of payment connections

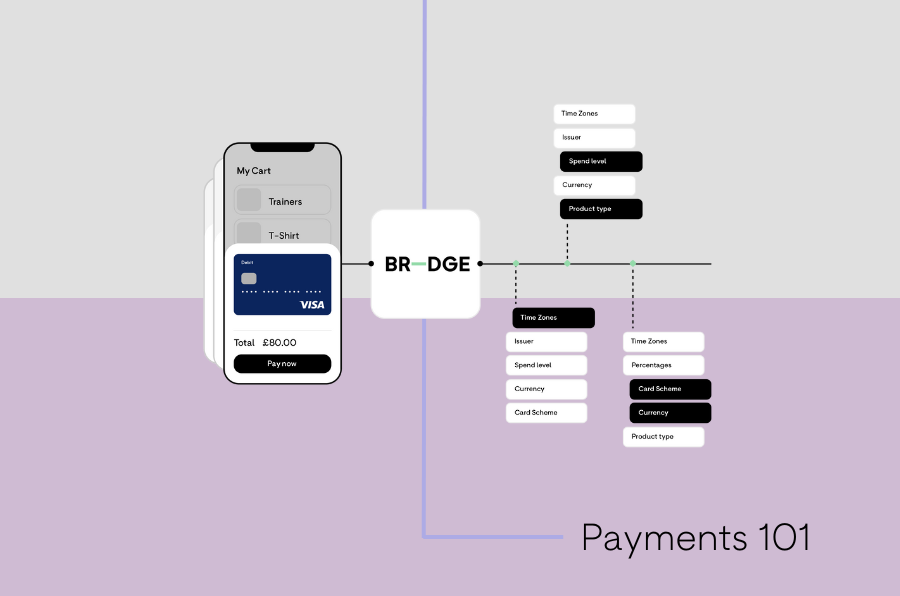

The greatest form of resilience is flexibility. By expanding your access to a wealth of payment connections, you can build a more resilient end-to-end payment process, capable of handling volume surges or technical outages. With payment orchestration platforms, like BR-DGE, you can connect to over 400 payment solutions via one single API. Not only is this highly efficient, but it provides you with the security and comfort of a comprehensive payment suite of providers to connect to, at the click of a button.

With greater access to payment service providers, acquirers and third-party tools, such as fraud, you can seek to:

- Manage payment failure at the checkout

Payment failure is common during peak trading, due to a higher volume posing increased risk for fraudulent activity. Some payment service providers and acquirers, also have limitations on the volume they can manage or are willing to underwrite in a specific time period. This can mean some payments fail unnecessarily. With access to a broad range of suppliers, you can build a retry workflow, that tries the transaction with an alternative acquirer to enable the purchase to complete. This not only protects valuable revenue for your organisation but provides a better customer experience too. Utilising detailed reporting available via a payment orchestration data centre, you can understand the patterns in behaviour and better design your payment experience and suppliers, to handle these occurrences.

- Handle trading surges, mitigating technical outages

In some instances, peak surges can cause the entire payment process to crash. As with payment failure, some providers will have limitations as to what they prefer processing, which could be volume, value or even time of day dependant. With payment orchestration, you can optimise resilient payment journey with a failover in place, which is automatically switched on when outages or technical issues arise with one supplier. Coupled with dynamic routing, this can be incredibly powerful to mitigate the challenges of seasonal or operational trading.

In the case of our client FirstGroup, utilising greater access to payment integrations, combined with dynamic routing eliminated their outage issues, saving over 6% of revenue (BR-DGE , First Group Case Study).

Optimise your payment workflow using intelligent routing

With intelligent routing you can look to split the volume of traffic to different providers, pre-emptively designing a solution that is resilient to peaks. Alternatively, you can set up volume levels based on provider commitment, best rates or even just build in a back-up, should your preferred supplier falter under the volume or technical requirements at any point during your peaks.

With a suite of new payment integrations at your fingertips, you next need to establish a workflow that is best optimised to your ecommerce needs. Utilising an intelligent routing engine gives you the ability to automatically direct your transaction traffic to your preferred payment partners, based on a suite of relevant criteria from transaction value, geographical location, time of day, acceptance rate, volume balancing and more.

Utilising load balancing techniques enables you to mitigate failed payments and the risk of outages automatically. Through insightful reports and real-time routing, solutions like BR-DGE will kick in and handle any immediate issues with payment processing and optimise, based on your direction, the best route for the payment to achieve transaction completion. This ensures all your payments continue to process and your customer can always purchase in a fluid and frictionless manner.

Why utilise payment orchestration to handle seasonal peaks?

As a merchant one of your key priorities is to ensure you provide a great end-to-end online purchasing experience and securely process transactions in an efficient manner for your customers. With large investment in marketing, website user experience, product profiling and point of sale incentives, it is critical at the last hurdle, the payment, that you deliver not just for your customer, but for return on investment and business growth.

Every sector experiences its own trading trends, such as Black Friday in retail, or “sunshine Saturday” in travel, but it is about building a resilient process to withstand and balance the load.

Delivering an exceptional customer experience

Even if your providers remain online a high volume of transactions can result in latency issues in your payment processing or checkout. This is amplified when you are operating on an international scale as different time zones can make it difficult to allocate time to maintenance and development without compromising your ecommerce platform. Any form of friction at the checkout can result in cart abandonment, with over 60% of surveyed consumers stating they will only spend 5 minutes or less booking before abandoning their basket (BR-DGER Consumer Survey).

With competitors just one click away and the cost to capture the attention of your customers at an all-time high, the experience is critical to ensuring return on investment and further, long-term loyalty. Outages and payment failure often creates disappointment and when surveyed over 65% highlighted it makes them feel frustrated (BR-DGE Consumer Data Survey).

By having a robust and resilient payments infrastructure, you not only secure revenue, elevate authorisation rates and reduce internal headaches, you provide a better customer journey promoting digital customer loyalty.

Maximising ecommerce conversions

Failed payments and outages not only impact customer loyalty, but your bottom line too. With access to additional payment providers and an intuitive workflow utilising dynamic routing in place, you mitigate the risk of lost revenue. With failover solutions in place, each transaction will be optimised to ensure the best chance of completion and you can confidently enter peak trading sessions knowing your payment technology stack is resilient and reliable.

Improving commercial leverage and negotiations with providers

With greater access to a wealth of payment providers, an additional benefit is commercial leverage. Traditionally, payment relationships are linear, with long-term contracts and changing providers comes with challenging integrations requiring time and money. With payment orchestration, you have access to the entire payments’ ecosystem through one single API connection. This enables you to test and trial new providers at speed, whilst also negotiating rates due to easier accessibility to the market.

Detailed data and insight, informs real-time decisions

To support you in making load balancing decisions, you need a detailed set of reports amalgamating all payment data sources into one clear, 360 source of truth. With payment orchestration, you are empowered to make data-driven decisions every day, with the tools to exercise powerful changes that improve authorisation, uptime and the overall experience for you and your customers.

In summary

Seasonal or product-related spikes are the lifeline of many businesses across many sectors. Your payment stack must be designed to handle surges in transactions to mitigate outages and failed payments, optimising authorisations and the best customer experience. Through enhanced connectivity, intelligent routing and real-time reporting, you can maximise load balancing techniques to control and optimise your payments workflow.

Interested in learning more about payment orchestration and load balancing, get in touch with the BR-DGE Builders today.

Related content