Where Do You Sit on The Payments Resilience Curve?

Enterprise payment setups are often a mix of old decisions and new fixes. A new payments provider added for one market, a local payment method built in for another, a token vault introduced years later, plus the patches that kept things moving along the way. It works, but not all of it works equally well.

A payments stack often shows its strengths and weaknesses side by side: some routes overloaded, some connections inconsistent, some components easy to change while others are left untouched. Taken together, that view tells you a lot about how far the setup will stretch on a busy day, or when something important changes. It also reveals how mature the payments function really is.

That’s the payments resilience curve in practice: a way of understanding how mature a payment set up is and how it needs to evolve over time. At one end, the stack works while everything is calm; at the other, it keeps trading through outages, traffic shifts, new partners and changing customer expectations. Most enterprise merchants sit somewhere in between, resilient in some areas and exposed in others, without a clear picture of where the gaps are, and what to prioritise next.

Seen this way, resilience isn’t a yes-or-no state. It develops over time, shaped by how payment systems are designed, connected and operated. The Payments Resilience Curve Assessment captures this progression, mapping how enterprise payment strategies evolve from fragile and reactive to adaptive, optimised and future-ready, and why those differences matter when pressure hits.

Five building blocks do most of the work in deciding where you sit on that curve:

- 1. Redundancy: Staying online when one route fails

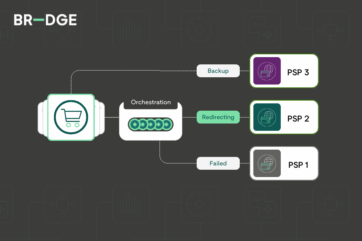

The first test is what happens if your main payment service provider (PSP) slows down or drops. In some setups, transactions start queuing and failing while teams raise support tickets and change settings under pressure. The tools to move traffic may exist, but nothing happens until somebody spots the problem and decides what to do.

In a stronger setup, a backup route is already live, tested and ready to take volume. Authorisations move in the background, customers carry on paying, and the incident turns into something you review later rather than a scramble in the moment.

- 2. Flexibility: Keeping payments in step with the business

The next sign of maturity is how easily payments keep pace with plans elsewhere in the business. When a new country, payment method or provider comes into the picture, do things slot into place or turn into a long list of one-off changes? If every launch means fresh integration work, new routing rules and extra reconciliation effort, the stack is rigid.

A more flexible setup uses an independent orchestration layer to manage providers, routing and local options. New methods can be added without a rebuild, local acquiring can be switched on quickly, and changes fit into the existing journey rather than sitting awkwardly around it.

- 3. Interoperability: avoiding lock-in to one partner

Once there is more than one route, the question becomes how well those routes work together. Tokens are the clearest example. When they live inside one PSP’s system, the business can look ‘multihomed’ on paper but still find it hard to move volume in practice. The same applies to fraud tools or 3-D Secure flows tied to a single provider. Any change in how or where payments are processed becomes riskier than it needs to be because key pieces are in the wrong place.

An interoperable setup puts shared components, especially tokens and core customer data, where they can support every route in use. That makes it possible to move traffic, add partners or change processing paths without asking customers to re-enter details or accept a weaker experience.

- 4. Optimisation: spotting where payments slip away

Even with strong routing and shared components, payment failures can still slip through the cracks. There might be a small dip in one region, an increase in soft declines on certain card ranges, or a rise in 3-D Secure failures after a browser update. None of these look like full-blown outages, but they still affect revenue and customer confidence. Teams further along the curve can see these patterns clearly and respond quickly. They test routes, compare schemes and adjust rules based on what the data shows rather than guesswork. Over time, those small, continuous improvements add up.

- 5. Future-readiness: keeping the checkout steady as things change

At the far end of the curve, the benefits show up directly in the checkout. If a card payment fails for a reason that could be recovered, the customer sees a clean alternative way to pay rather than an error page or an unexplained decline. If a provider struggles during a busy period, traffic has already shifted. When a new digital wallet or buy now, pay later (BNPL) option becomes important, it can be added without months of disruption. At this stage, the stack is strong enough that change feels routine instead of risky.

What you can do next

Everyone sits somewhere along the resilience curve. You might be focused on reducing dependence on a single route, improving the speed of new launches, or using data to prevent avoidable declines. Understanding where you are helps you decide what to improve next and what you can already trust.

We’ve built a Payments Resilience Assessment tool to help teams benchmark their maturity across the five critical areas of resilience: redundancy, flexibility, interoperability, optimisation and future-readiness.

Our assessment tool gives you a clear score of where you sit on the payments resilience curve. It shows you where risk and opportunity sit and highlights what to prioritise next, whether you’re stabilising today or planning for growth.

See where your business sits on the Payment Resilience Curve.

Related content