How Your Tokenisation Model Impacts Your Business and Why True Interoperability Fuels Growth

Your tokenisation strategy can quietly decide your resilience, payment agility and cost base.

Your payments strategy isn’t about whether to tokenise; it’s about delivering the right tokenisation for your business.

Yet, tokenisation is often treated as part of the payments plumbing. In reality, tokenisation can impact authorisation rates, how quickly you can switch or expand, and impact the total cost of keeping payments running.

Payments leaders should view tokenisation as a strategic choice, not a tick box exercise.

Good tokenisation strengthens security and reduces fraud and PCI scope. Great tokenisation also creates commercial leverage, gives you flexibility across PSPs, and enables faster global expansion.

This blog explores how different tokenisation models impact your business and why true interoperability multiplies growth.

What is tokenisation?

Tokenisation replaces the Primary Account Number (PAN) with a randomised string of characters, a non-sensitive token, that can be stored securely in a vault and used for payments. The merchant keeps hold of the token information for future processing, but it holds no inherent value. This reduces exposure to data breaches and simplifies the compliance burden.

But not all tokens are created equal. PSP-issued tokens are created and can only be used with that PSP, which suits merchants who expect to stay inside that single provider’s environment. Network tokens are issued by the card schemes and kept current by the issuer, so credentials stay up to date when cards change and can be used across compatible providers. Some PSPs do not support network tokens.

The practical approach is to support both, so every transaction is tokenised, and your routing can choose the most effective token type for performance and cost.

For payments leaders, the crucial point is token interoperability. Tokens that can travel across providers help protect revenue and keep options open when you need to route, switch, or scale

The decision hiding in plain sight.

Tokenisation can be a control point for your payment strategy, but when locked inside a single payment provider’s tech stack, interoperability is limited, resilience is reliant on one vendor, and optimisation is constrained. The right tokenisation model should protect your business continuity during incidents and provide you with the freedom to optimise routes and costs without the need to re-capture credentials.

The different types of tokenisation models

Token-forward

Token-forward is a pragmatic choice when speed to implement is the top priority for your business, especially if you expect to stay with one PSP long-term. As gateway or PSP tokens typically live inside the PSP’s environment, when you need failover, to implement new routing controls or add a different provider, a new re-tokenisation project will be required. This means a longer-term payments strategy using the token-forward model will likely require multi-PSP management and there will still be significant fragmentation and gaps in token use.

Single provider stand-alone vault

A single provider centralised vault will enable your business to reduce PCI scope, improve resilience and ease some token migrations. However, token portability and optimisation features will depend on the vault provider’s adapters and integrations. While adding additional integrations or new payment methods is possible, it will likely incur custom work and varying delivery timelines.

Agnostic vault

A provider-neutral vault is designed to facilitate multi-PSP routing, rules-driven failover, and merchant-controlled governance. Tokens can be used across routes and processors, enabling live failover, continuous optimisation, and faster market entry. Ideal for enterprise businesses, agnostic tokenisation works best with payment orchestration; however, the payoff is independence, and a future-proofed payments strategy from the start.

What this means for your business

When there’s a decline in performance during your peak

When your business is in peak trading, it can be unforgiving. If your authorisation rates slip, every second of delay can result in customer dissatisfaction, an influx of support queries and lost revenue. Continuity of authorisations is paramount, with as little friction as possible for customers who are processing payments.

When your tokens are portable, you have the room to act. That’s because the same stored credentials can be used across multiple PSPs, you can re-route traffic to stabilise authorisation rates without asking customers to re-enter details. This avoids emergency batch workarounds to protect conversion and keeps transactions flowing when demand is at its highest.

When you need more control over your payments

Payment control is the ability for your business to choose the best-performing, most cost-effective payment route. If your tokens are tied to a single provider, your options may narrow, and trying to optimise becomes a longer, more rigid process. When tokens are portable, your team can optimise quickly and easily, comparing route performance and implementing the best-performing path without re-capturing credentials.

For example, you can apply rules by market, transaction value or card type, then tune routes for both authorisation success and cost

When you enter a new market or add new payment methods

Business expansion plans should not be slowed down by tokenisation projects. An agnostic vault approach allows you to connect new PSPs with ease, while continuing to use the same customer credentials already on file. There is no need to re-capture details, which removes risk for returning customer friction.

The practical effect of agnostic tokenisation is faster time to revenue. Product teams can launch in new regions more easily, and compliance teams benefit from a consistent token model that reduces scope. Your business is able to move quickly without compromising on compliance standards or impacting the experience for existing customers.

When you negotiate renewals

If your token model makes switching PSP hard, renewal becomes a price discussion without the leverage of choice. With a centralised, flexible token strategy, you can run real comparisons and present performance evidence and, if needed, transition volume to alternative providers.

Why interoperability matters.

Interoperability transforms tokenisation from a security tick-box exercise into a central pillar of a scalable payment strategy. By eliminating the risk of single points of failure, incidents no longer halt transactions. Moreover, as tokens can travel wherever performance is strongest, payment optimisation becomes effortless. With interoperable tokens, your business remains expansion-ready.

Interoperability aligns technology with business strategy, allowing businesses to retain the freedom to choose the options that are right for them. This freedom enables businesses to adapt their choices as markets evolve without the need for lengthy token migration projects.

7 questions to ask when deciding on your tokenisation strategy.

- Will stored credentials work across multiple PSPs ?

- Can we failover live during an outage using the same tokens?

- How quickly can we launch into new markets without a lengthy tokenisation project?

- What technical, legal, and operational switching costs appear at renewal?

- Do tokens enable routing freedom to optimise for performance and cost?

- Are you able to view all your token performance in one place?

- How does this model reduce PCI scope over time and support data residency needs?

- Will this approach keep us future-ready as schemes and standards evolve?

BR-DGE Vault

For BR-DGE, the decision when implementing tokenisation is simple. Your tokens should travel with your business.

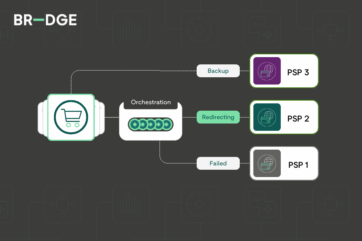

BR-DGE’s agnostic Vault treats tokens as a portable asset, enabling multi-PSP routing, rules-driven failover and merchant-controlled governance. BR-DGE Vault balances the speed to go live with payments control, unlocking commercial leverage, global expansion and new PSP implementation. BR-DGE Vault is a strategic foundation for a resilient and scalable global payments strategy.

Related content