Pay by Bank Goes Mainstream as Demand for Checkout Personalisation Grows

Merchants looking to optimise conversions through their digital channels and deliver the best possible user experience are increasingly personalising the checkout experience, offering a mix of payment, loyalty and fast-track service options tailored to customer preferences. Open Banking payments are becoming an important part of that mix, as BR-DGE’s VP Commercial, Tom Voaden, told FF News at the recent MPE Conference in Berlin.

Delivering personalised payments is becoming common practice in many markets across a wide range of sectors. However, ‘personalised’ means more than simply offering a wide range of payment methods: it means offering the preferred payment options for the vertical, market and customer group.

Merchants in any sector will have diverse reasons for selecting the payments mix that works for them. Finding the right payments mix involves an assessment of the costs incurred when using that method, as well as assessing user familiarity, and how frequently browsers convert to shoppers using a particular method. When evaluating a payment mix, merchants can set KPIs and use metrics to evaluate performance – and identify where new methods might drive more conversions and higher revenue at lower cost - all without offering so many options that consumers feel overwhelmed.

A Growing Solution

In recent years, Open Banking payments have proven increasingly popular, especially in sectors where it can offer an improved experience or commercial advantage. In the travel sector, for instance, high-value transactions with low profit margins make Pay by Bank an attractive proposition for merchants – not just thanks to the lower costs on offer, but also because authorisation rates are higher, fraud is lower and cashflow is easier to predict.

Merchants in the gaming sector have very different reasons for choosing Pay by Bank. Firstly, it helps deliver the smooth, rapid transactions gamers are looking for when it comes to pay-ins to fund their gaming, and pay-outs to bank their winnings. Likewise, the importance of KYC in gaming makes Pay by Bank attractive, since the Open Banking rail used for Pay by Bank can also be used for AIS calls to confirm a user’s bank details and identity. The speed and convenience of Pay by Bank also appeals to customers involved in share and currency trading: having funds turn up fast in a trading account helps users make the trades they want when share or currency prices are optimal.

More broadly, there's strong adoption of Pay by Bank by merchants in high-value sectors such as car sales and high-end luxury goods, since it supports much higher transaction limits compared to almost any credit card offering, with funds available confirmed via an AIS call to the consumer’s account.

“One million more UK consumers are using Pay by Bank every week.”

The Open Advantage

Merchants have found that once a consumer uses Pay by Bank, even if that’s via another merchant, they typically trust it and are more likely to convert from browsers to shoppers. Because it offers a slick customer journey, cart abandonment rates also decline. However, as with any payment method, merchants must use their judgement as to where Pay by Bank will work best – for instance, in those sectors mentioned above, and in any high-value sector where a great payment experience is part of the brand promise.

For consumers, Open Banking payments make it easier to control finances, since there’s no credit account or lag in time from purchase to the payment clearing – while authentication via Face ID or fingerprint on mobile device means there’s no need to input card details, One-Time Passcodes or passwords. It’s also possible to use Open Banking payments for higher-value transactions such as domestic appliances or cars without increasing friction, since verification of bank details and consumer identification are both part of the purchase process.

“80% of digital merchants intend to add Pay by Bank as a method over the next year.”

It's no wonder, then, that the number of UK consumers using Pay by Bank is growing at one million per week, according to Visa – or that data from TrueLayer suggests 80% of digitally active merchants intend to add Pay by Bank as a payment form over the next twelve months. Speaking alongside Tom Voaden at MPE, Mariko Beising, VP of Financial Services and Partnerships at TrueLayer, said: “Where we saw early adoption by banks and financial services firms, we’re now seeing UK Food & Beverage companies like JustEat adopt Pay by Bank, not to mention aviation and leisure companies like RyanAir. Over the next five years, we’ll see widespread adoption of Pay by Bank as consumer awareness grows, and more merchants adopt it as part of a drive to broaden the range of options at checkout and deliver optimal experiences.”

At BR DGE, we expect the slick user experience enjoyed by users in markets like the UK and Germany – where a version of Pay by Bank has long been preferred over credit cards – to flow into other markets over the next three to five years.

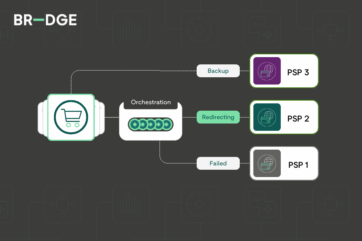

Orchestrating Open Banking Payments

Although many merchants are keen to start accepting Open Banking transactions, they may be understandably wary about how best to integrate the technology to their website, as well as where and when to offer it. Working with an orchestrator can help merchants overcome this and help with the technical uplifts required. Tom added: “Merchants who are eager to explore Open Banking payments are increasingly turning to orchestrators as a means of enabling Pay by Bank without taking on complex integrations and the associated costs. Through our partnership ecosystem we’re able to offer merchants rapid and secure access to Pay by Bank – alongside a wide range of other payment options that help merchants to optimise and flex their checkout experience according to user preferences in any given channel, sector or country.”

Click here to watch the full interview with BR-DGE’s Tom Voaden and Mariko Beising from TrueLayer.

Related content