Network Tokens: The Unsung Hero of Seamless Online Payments

At the recent MPE conference, BR-DGE’s VP Commercial, Tom Voaden, spoke to FFNews about the benefits of tokenisation alongside Mastercard’s Brandon Trollip. Click here to watch the video (15 mins), or read on for a quick summary of how tokens power more successful smoother checkout experiences – and what’s coming next.

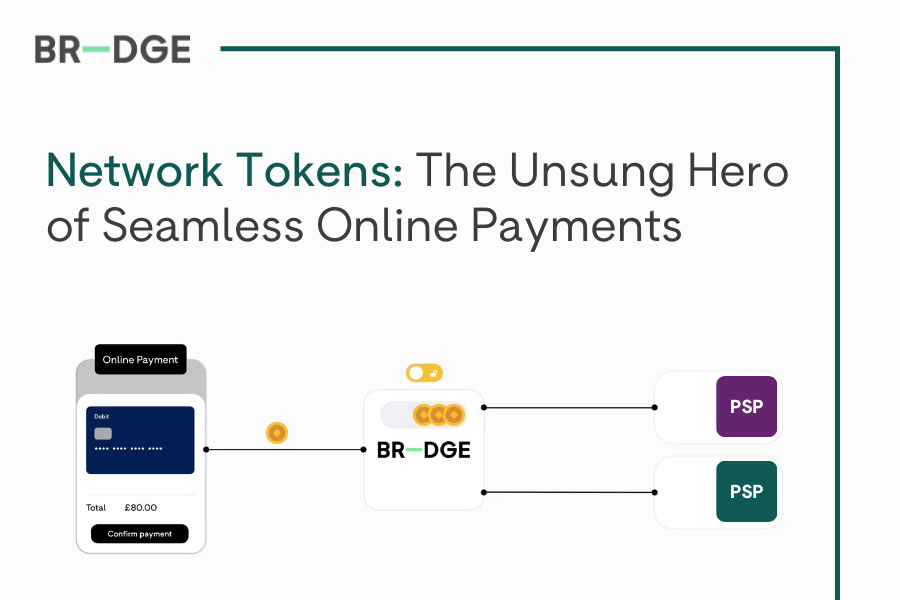

Balancing data security and fraud prevention with delivering a seamless checkout experience is a constant battle for merchants. Too much friction in the payment process from things like repeat requests for personal data, or multiple authentication steps are no longer acceptable to consumers. As a result, the industry is turning to tokenisation to improve the customer experience, increase security and deliver more flexibility and power to merchants.

For more insight on how tokens work, see our Payments 101 blog on Tokenisation.

Tokens: delivering safer, smoother, faster user experiences - and more…

There are various types of payment token, each with different pros and cons. PSP or gateway tokens, for instance, help to support transaction processing by encrypting sensitive card information between merchants and specific payment gateways. Device tokens, on the other hand, are stored on a user's device (such as a smartphone), which is then accessed via biometric security, passcodes or other security features, in order to complete a transaction.

By far the most powerful type of token, and the one currently the most talked about, is the network token. Because these tokens are issued by the card network – such as Visa or Mastercard, and kept up to date by the issuing bank, they power greater interoperability and benefits.

Network tokens remain continuously encrypted throughout the payment chain, offering enhanced security. They also cut fraud rates by an average 26% and typically increase authorisations by between 3% to 13%, depending on the region.

Network tokens also enable a reduction in payment failures, since traditional card-on-file barriers are removed, or reduced. For instance, if a customer’s card expires, the token associated with their account continues to work at the checkout because it's automatically updated with the replacement card details by their issuer. This is a particularly helpful feature where cards are being used as part of a recurring payment schedule, or as the stored payment method behind a one-click checkout.

The future: full tokenisation, automated tolls, contracts and more…

In the MPE interview, Mastercard’s Brandon Trollip said that around one-third of Mastercard’s transactions already feature network tokens – and that he expects all Mastercard transactions to feature network tokens by 2030. He predicts we’ll start to see tokenisation used in other areas of commerce too, from paying road tolls through to confirming contract receipt and signature.

Adding his support to Brandon’s view, BR-DGE’s Tom Voaden predicts that, “ultimately, we expect all transactions to be tokenised – and for merchants, banks, and others to be able to access a full overview of customer spending through Payment Account Reference tokens, as well as tracking transactions from end-to-end. At present, we’re seeing a huge rise in token adoption – next, we’re going to see their power and utility increase as the benefits become more widely appreciated.”

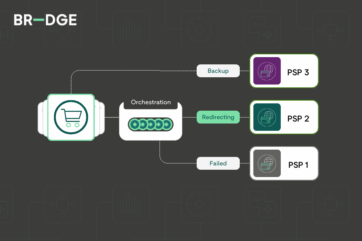

To help merchants optimise their token strategy, BR-DGE's solution, Vault, combines different token types and services, harmonising them into a single service. BR-DGE Vault simplifies the use of tokens for merchants, enabling them to use network tokens as widely as possible, while supporting a range of other tokens, to power flexible routing and enhanced visibility of transactions across multiple PSPs.

Related content