Beyond cards: navigating the alternative payment methods landscape

Alternative payment methods, (APMs) have seen remarkable expansion in recent years, driven by technology advancements and evolving consumer preferences. This surge has led to many APMs surpassing traditional options like debit and credit cards in certain markets and demographic groups. Projections suggest that by 2026, card usage is expected to decline to 33%, while BNPL services are anticipated to experience a 70% growth from 2021 to 2026 (source: Truelayer).

The shifting landscape of consumer preferences

When it comes to payment methods, there are many different factors behind the consumer behaviour and preferences. Not only do the payment methods of choice vary across demographic groups and countries, but across different kinds of purchases too. The selection of payment methods available has a significant impact on checkout conversion rates, making it a vital consideration for merchants across all industries.

According to BR-DGE's 2023 consumer survey:

- 50% of shoppers think that having more payment options at the checkout impacts how trustworthy a merchant is.

- 44% of retail shoppers said they’re likely to spend more money if the organisation offers alternative financing products, such as Buy Now Pay Later and 42% of travellers said they would be open to utilising an alternative payment method for purchasing travel or a holiday.

- Over 43% of consumers choose which payment method they want to use based on the transaction value. This is particularly true among younger consumers – with 58% of Gen Z shoppers choosing their payment method based on transaction value.

This handful of stats alone highlights how important it is for merchants to offer the right payment methods for their customer base. Merchants who align with evolving customer preferences are far better positioned to attract new customers, build trust and deliver an enhanced shopping experience.

What are key types of alternative payment methods? Digital wallets, Open Banking and Buy Now Pay Later (BNPL) are among the most popular APMs – making them the most important international payment methods to support.

Buy Now Pay Later (BNPL)

The number of Buy Now Pay Later adopters has significantly increased over the past few years, half of UK adults (50%) have used BNPL services at some point, approximately 26.4 million people, which is up from 36% at the start of 2023. The rising popularity of BNPL products benefits is driven by many benefits for consumers; ease and convenience, access to interest-free payments, pay for purchases consumers couldn’t otherwise afford, and try on items that are delivered before they purchase. As consumer preferences continue to dominate the payments landscape, the rise of BNPL products showcases the evolving dynamics of the modern payment landscape.

Digital Wallets

The convenience and security offered by digital wallets have played a pivotal role in the rise of the use of digital wallets, reshaping the way we perceive and engage with payments. The popularity of digital wallets has increased over the past few years, with global digital wallet sales predicted to exceed $10 trillion by 2025 - a remarkable 83% increase from 2020. As consumers increasingly seek efficient and contactless payment options, digital wallets are proving to be a formidable player in the financial landscape, offering a convenient tool for transactions.

Open Banking

Open Banking is the process of enabling third-party payment services and financial service providers to securely access consumer banking information, such as transactions and payment history, utilising an API integration. The increased demand for Open Banking payments is fuelled by a growing awareness of the transparency and competition it introduces, as consumers seek more control and a seamless payment experience. The value of open banking transactions worldwide reached 57 billion U.S dollars in 2023, and this momentum is expected to grow further in the next few years. As consumers seek innovation and smooth transaction experiences, Open Banking provides significant benefits for both the merchant and consumer. For merchants, it offers enhanced financial visibility, streamlined transactions, and ultimately fostering greater customer satisfaction to drive business growth.

Why are alternative payment methods so important?

Embracing APMs has become crucial for all merchants. Customers want the choice of a broad range of payment method options, allowing them to transact in ways that suit their preferences and lifestyle.

Failing to offer the right payment methods can be a costly mistake - over 40% of consumers will stop a purchase if their favourite payment method isn’t available, - which means your customers are only a click away from heading over to your competitors who offer better payment choice.

The digital shift over the past few years has unlocked the potential of building a global audience, but your payment methods need to be suitable for a global marketplace. Local payment methods play a pivotal role in allowing your business to adapt to local payment preferences and navigate the intricacies of different markets.

A seamless payment experience

By adopting the payment methods that your customers prefer, you can build a targeted payment strategy that drives business growth, secures market share, improves acceptance rates and reduces cart abandonment.

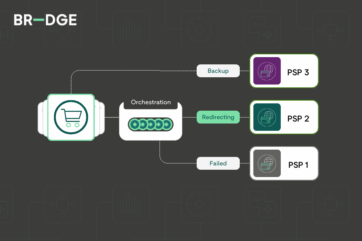

Whether you are looking to strengthen your offering for your existing market or deliver local payment solutions for new global target audiences, BR-DGE Payment Orchestration allows you to connect with over 100 payment providers and over 200 alternative payment methods, from e-wallets to card schemes and Buy Now Pay Later solutions.

For more information on how BR-DGE can support you to provide a streamlined payment experience for your customers, contact us today.

Related content