The Real Value of Payment Orchestration: Thomas Gillan and Robin Amlôt

Join us as we explore the highlights from a fascinating podcast episode on the value of payment orchestration with BR-DGE CEO Thomas Gillan, hosted by Robin Amlôt, Managing Editor at IBS Intelligence.

In this recap of the 10-minute IBS Intelligence podcast, Thomas dives into how payment orchestration optimises payment flows, boosts authorisation rates, and reduces friction; allowing businesses to focus on their core strengths. He tackles key questions from Robin on BR-DGE’s differentiation in a crowded market and the significance of a white-label offering.

The value of payment orchestration for enterprises

The value of payment orchestration is ‘very much a hot topic in payments at the moment,’ comments Thomas.

Critically for BR-DGE it’s around optimisation of the payment flow. Thomas points out, “It’s about looking at the payment journey from the beginning, increasing the authorisation rates and acceptance rates, and for the consumer it’s about removing as much friction as possible during the payment process.”

Can payment orchestration improve transaction success rates?

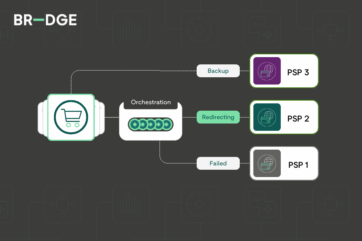

Payment infrastructure is highly complex, with numerous players involved across the value chain. Orchestration stands out as a vital tool in this landscape, simplifying and optimising these intricate systems.

Thomas explains, ‘Orchestration can be used to build a ‘best of breed’ stack and getting the data points from the payment journey can allow the merchant to dial in those elements that can help improve authorisation and acceptance rates.”

As Thomas points out, there isn’t necessarily a ‘silver bullet’ or a one-size-fits-all solution. However, leveraging orchestration tools has become essential for driving improvements and achieving success in these areas.

Exploring new horizons: white-label payment orchestration

Orchestrators often work behind the scenes, integrating with payment systems and processors to make transactions as efficiently as possible.

BR-DGE was initially built with a focus on the direct to merchant side of orchestration, building trust and reliability with merchants across industries including digital goods, gaming and travel.

White-label solutions from BR-DGE

The launch of our white-label solution (where acquirers, PSPs and platform businesses white-label BR-DGE's technology in order to offer orchestration solutions to their own merchants) is a natural evolution of this. Using these solid foundations and proven platform to demonstrate that, as an orchestrator, BR-DGE can effectively process the large volumes that acquirers need to handle.

This enables payment providers, gateways and acquirers to take real control over their payments and provide trustworthy solutions which benefit both their merchants and end consumers.

Thomas explains, “We want to empower optimisation of the payment journey and we can do that by helping processors, platforms, ISVs, to launch new products, bring in third party products, move into new markets at speed and critically, provide resilience.”

Standing out in a booming orchestration landscape

Over the past decade, the payments landscape has seen a surge of new providers entering the market. While this offers consumers more choices in how and when they pay, it has also resulted in ‘significant fragmentation’, Thomas points out.

Orchestration plays a crucial role by unifying diverse payment technologies into a cohesive and streamlined system. However, the challenge lies in the crowded marketplace, with many providers offering nearly identical services, making it difficult to distinguish true value from similar claims.

How does BR-DGE compete?

Thomas explains that BR-DGE aims to “identify the optimal journey for every payment and then being able to work with both the merchant and the payment provider to route that traffic to those end points, ensuring that the best possible experience and authorisation rates are obtained.”

BR-DGE provides the necessary and optimal ‘plumbing’ for payment providers. Thomas adds, “We’re an enablement capability that allows the merchant to build that best-in-breed stack. There are many different providers in the market but it’s about using this as a tool to be able to route the transactions to the right place at the right time.”

Streamlining payments: letting businesses focus on their core offer

For many online merchants, managing their payment stack isn't where they want to spend their time and resources. They need these processes to run smoothly in the background, ensuring reliable transactions without constant oversight. While revenues, transactions, and refunds are vital to success, their priority lies in staying customer-focused and delivering exceptional service.

How does payment orchestration solve this challenge?

Orchestrators like BR-DGE can be effectively viewed as the ‘payment microservices in an enterprise stack’, explains Thomas.

“The consumer wants to pay they want to, in the least amount of clicks as possible. The merchant wants to support this process without accepting any additional fraud risk, so they can deliver a great customer experience and maximise revenue. We believe orchestration delivers all of those goals and does it in a unified way that makes scaling much simpler, so businesses can focus on what’s important to them.”

Explore the insights in full by listening to the full IBS Intelligence podcast here.

For more key payment insights, explore our knowledge hub.

Related content