The Payments Resilience Playbook

Discover how leading merchants are turning resilience into the competitive advantage

What’s inside the playbook?

Enterprise merchants are under pressure

of enterprise e-commerce merchants experienced payment outages in the past 2 years

lost £1.1million to £10million; 4% lost over £10million

say payment limitations prevented or delayed expansion into new markets

Five Building Blocks of Modern Payments Resilience

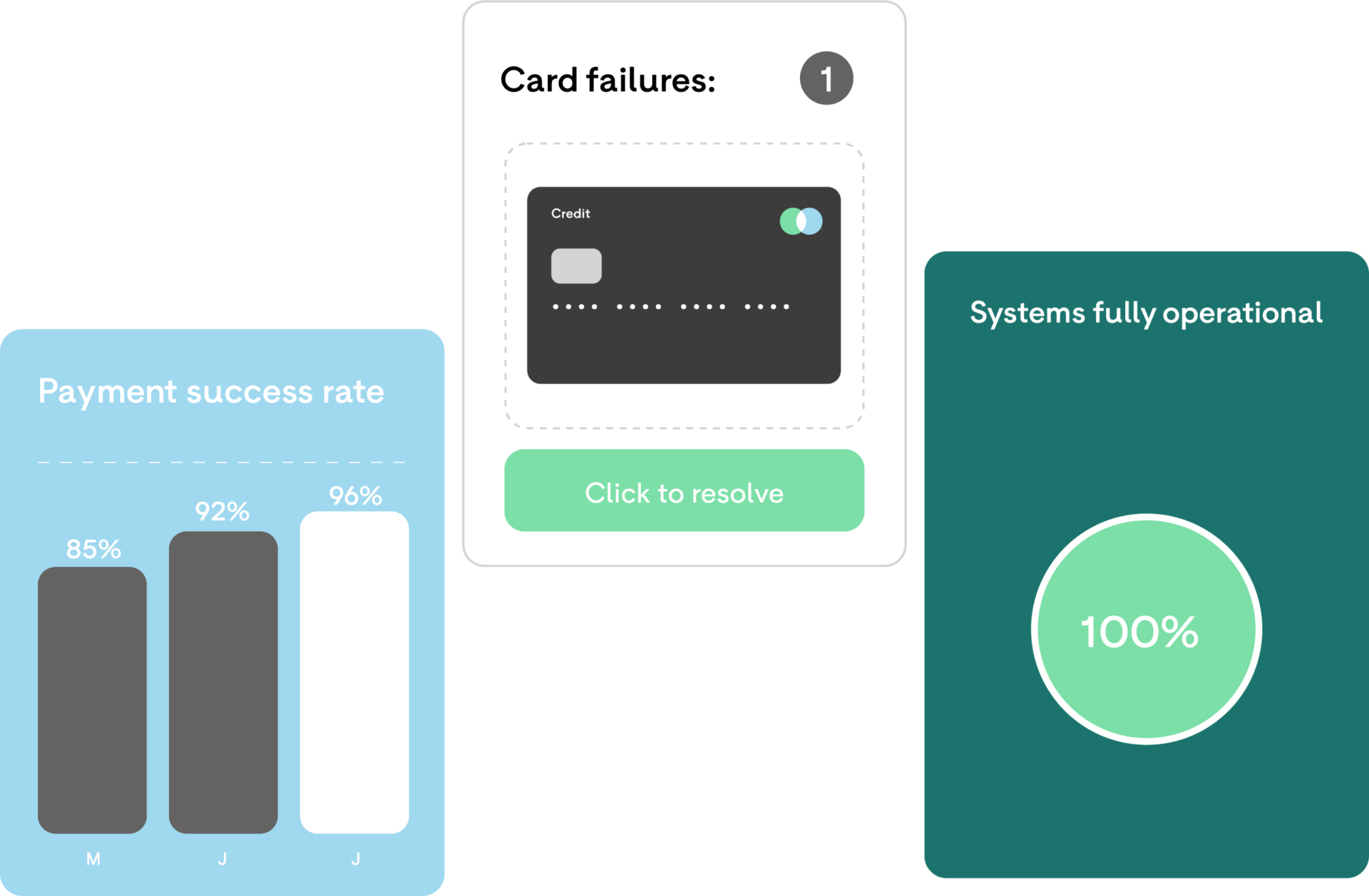

- Redundancy: Protect against outages and maintain uptime.

- Flexibility: Adapt your stack as fast as your business changes.

- Interoperability: Connect systems that work in harmony.

- Flexibility: Adapt your stack as fast as your business changes.

- Future-Readiness: Prepare for new technologies and customer expectations.

Turn resilience into your growth strategy

Resilience isn’t just about having a backup plan. It’s a boardroom priority.

Flexible, interoperable and optimised payment infrastructures maximise uptime, improve performance, reduce costs and accelerate long-term growth.

The Payments Resilience Playbook redefines resilience for modern merchants.

Inside, you’ll learn how to:

Eliminate single points of failure with smart redundancy

Build flexible and interoperable systems that scale with your business

Continuously optimise performance and approvals

Prepare your payments infrastructure for what's next

Discover how leading merchants are turning resilience into the competitive advantage

Discover more from BR-DGE